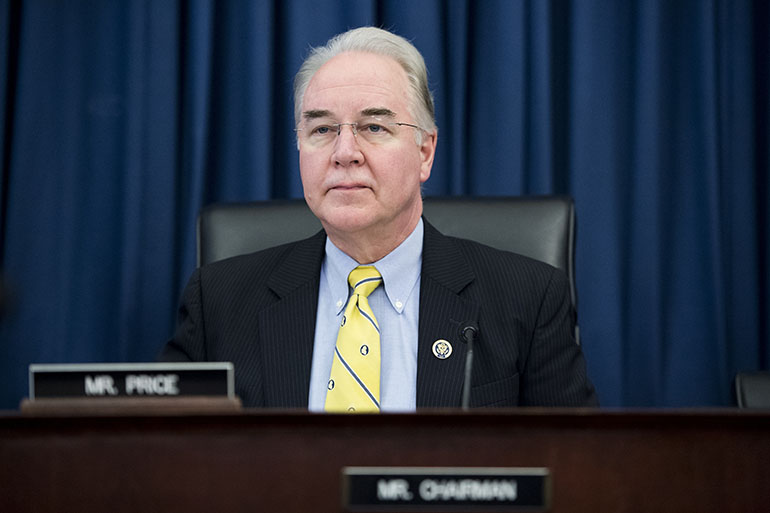

Republicans on the Senate Finance Committee Wednesday morning pushed through the nomination of Rep. Tom Price without any Democratic votes. The Senate Democrats have been asking for more time to look into questions that he may have misled the public about issues in his financial background.

Here are some of the issues still swirling around Price:

Insider deal or just good fortune? Kaiser Health News reported Jan. 13 that Price got a sweetheart deal in 2016 on a penny stock in an Australian drug company, and Democrats grilled him about it at his confirmation hearing. The Georgia Republican said he first invested in the company after discussing it in 2014 with Rep. Chris Collins, R-N.Y., a major stakeholder in Innate Immunotherapeutics. The opportunity to buy more stock in a private placement was “available to every single individual that was an investor at the time,” Price testified. His account was called into question again Monday in a Wall Street Journal report. Company chief executive Simon Wilkinson confirmed that a limited number of U.S. investors were offered the private placement, which was discounted by 12 percent, according to company documents. U.S. investors who bought in included Price, Collins, Collins’ chief of staff and a former Buffalo congressman, records show. Senate Democrats want more details.

How much was the stock really worth? Price testified that he fully disclosed his Innate Immunotherapeutics investments to the House Ethics Committee. Yet the Senate Finance Committee staff discovered in its review that he had undervalued his stock holdings and asked him to correct the filing. Records show Price upped his estimate of the stock’s value from $50,000 to $100,000, as reported in a December disclosure, to the actual market value of $100,000 to $250,000. Price called the discrepancy a “clerical error.”

An ethics probe that Price forgot to mention: Price checked “no” when asked in a Senate Finance Committee questionnaire if he had ever been subject to an ethics complaint or investigation. But the committee staff reminded him that he had. In 2010, the Office of Congressional Ethics looked into a lunch hosted by Price’s campaign committee, offering one-on-one meetings between Price and lobbyists working on a financial reform bill that the congressman would vote on the next day. The ethics office referred the issue to the House Ethics Committee to determine whether Price improperly solicited campaign funds. The House Ethics Committee found no wrongdoing in 2011. Price said answering “no” was an inadvertent mistake.

Intervening with health officials, including for a top campaign contributor: Price has written dozens of letters to the Centers for Medicaid & Medicare and the Food and Drug Administration, and scheduled phone calls on issues as diverse as stem cell treatment oversight to a hot pepper ingredient in pain creams. One intervention was for a Georgia company that later became a top campaign contributor, Kaiser Health News reported last week. Price wrote to CMS administrator Marilyn Tavenner concerning the reimbursement for a skin graft made by a biotech company in his district, MiMedx. The Medicare pay raise that followed was a “real win” for the company that uses discarded placentas to make wound-healing products, according to the company CEO’s statements to investors. Asked about the matter, an HHS spokesman and former Price staffer defended the lawmaker as only acting “to improve the lives of American people.”

Did Price’s actions boost the value of his investments? Senate Democrats have questioned whether Price took official actions that could boost the value of health stocks in his portfolio. Time Magazine reported that Price bought as much as $90,000 in stock in six pharmaceutical firms before leading a legislative effort that would benefit the companies’ bottom line. Also, CNN reported that Price invested in the medical device firm Zimmer Biomet before leading another legislative push that could have helped that firm. Price’s team has disputed the CNN account. Price maintains that all of his investments were picked by his broker, with one exception — Innate Immunotherapeutics.

Democratic lawmakers, meanwhile, wrote a letter Monday calling on Price to provide communications on the stock buys and documents that would “determine how much control he actually exercised over his investments in the health care sector.”

This article was updated to note the Finance Committee vote Wednesday.