For some Medicare beneficiaries, the good times seem to keep rolling along.

For seniors enrolled in private Medicare plans, premiums will drop by an average of 4 percent in 2012 while benefits remain stable, Obama administration officials said today. Last year CMS projected an average 1 percent drop in 2011 premiums, but the actual drop was 7 percent.

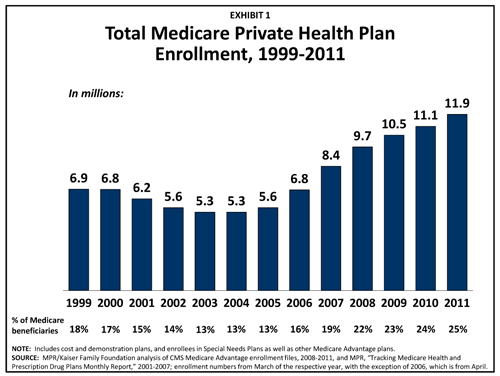

The plans, called Medicare Advantage, are offered by health insurance companies as an alternative to traditional, government fee-for-service Medicare. Nearly 12 million seniors are in private Medicare plans, about 25 percent of all beneficiaries.

Enrollment in the plans is expected to grow by 10 percent in 2012, said Jonathan Blum, deputy administrator for the Centers for Medicare and Medicaid Services. Blum said health plans are also lowering co-payments and deductibles.

He attributed the premium drop to HHS’ strong negotiations with plans as well as the companies’ continuing desire to serve the market.

Open enrollment in the Medicare health plans starts Oct. 15, a month earlier than in past years. It will run through Dec. 7.

Lower premiums and enrollment growth in the plans is the exact opposite of what health insurers predicted would happen after the federal health law was approved and reduced payments to the plans by an estimated $136 billion over the decade.

Many critics had raised fears that Medicare benefits would shrink and premiums would rise. “Instead we are seeing just the opposite,” said Health and Human Services Secretary Kathleen Sebelius. “Medicare plans are stronger than ever and beneficiaries continue to have access to affordable options.”

The Medicare Advantage plans came under fire during the health overhaul debate from critics who say the government pays too much to the companies running them. The $136 billion cut to the plans was used to help the Obama administration pay for the cost of expanding coverage to 32 million Americans through expanded Medicaid eligibility and subsidies for people buying coverage in new insurance exchanges starting in 2014.

Federal payments were frozen to Medicare Advantage plans this year and are dropping by less than 1 percent in 2012. Larger payment drops are expected to kick in later this decade. Last month, the Obama administration announced that premiums for private Medicare prescription drug plans would fall slightly.

The health care law tried to soften the impact of Medicare Advantage cuts by providing billions of dollars for quality bonuses for highly-rated plans that received four or five stars in a government grading system.

Then, in a policy shift last fall, HHS decided to lower the bar for bonuses. Average-quality plans garnering just three or three-and-a-half stars would also get bonuses, although at a lower percentage than top-tier plans. The HHS decision means more than 90 percent of Medicare Advantage enrollees are in plans now eligible for a bonus. Under the tougher approach Congress took in the health law, only about 33 percent would have been in plans getting the extra payments.

Dan Mendelson, the chief executive of consulting firm Avalere Health, said plans are lowering premiums because their costs have fallen as their members have used fewer services in the midst of the economic downturn.

Plans are also seeking to expand their market position by attracting new members with lower premiums, Mendelson said. They increasingly view Medicare as one of their most stable business lines, particularly compared to commercial market where fewer employers are providing health coverage.

America’s Health Insurance Plans, the industry trade group, said it stands by its predictions that program will soon run into trouble as a result of health law funding cuts. “As these cuts take effect in the coming years, Medicare Advantage beneficiaries will face higher out-of-pocket costs, reduced benefits, and fewer health care choices,” said AHIP spokesman Robert Zirkelbach.

He noted that the Congressional Budget Office projects that as a result of these cuts in the health law, Medicare Advantage enrollment will drop to 7.5 million by 2018.

This post was updated at 1:00 p.m.