Americans continue to struggle to pay their medical bills, and even the 2010 health care overhaul may not ease their financial burden.

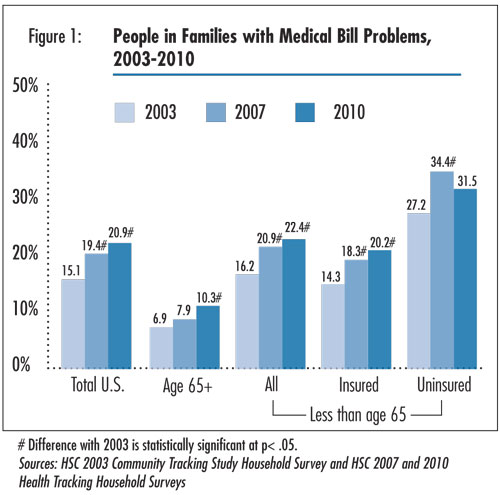

A new survey from the Center for Studying Health System Change and the Robert Wood Johnson Foundation shows the percentage of American families having difficulty paying their medical bills did not increase from 2007 to 2010, despite the economic downturn during that period. But the proportion with medical bill-paying difficulty in 2010 was more than one-third higher than in a similar survey in 2003. Overall, the national study shows that one in five Americans reported trouble paying medical bills last year.

One of the co-authors of the study, Anna Sommers, says these proportions, while dramatic, aren’t that surprising considering the way consumers spend money in a downturn economy. “During a recession we expect [people] to have more medical debt, more medical bill problems, but we have to remember there are recessionary effects on health care spending and health care prices. When income falls, there is a lower demand for health care. Economics tells us that more income yields more demand for health care. So when people have less disposable income, there is less of a demand for health care.”

Those with the most medical billing problems fell in low- to middle-income levels and averaged around $6,500 in medical debt. More than half of those families paid off “none or little” of their medical bills and said that it will take more than a year to pay off their debt. More than 17 percent of people with medical debt expect it will take longer than five years to pay off.

Employer-sponsored insurance coverage doesn’t make a dent, according to Sommers. “Many of these folks who’ve been hit by medical debt have employer-sponsored health insurance,” Sommers says. “And these people will not be eligible for subsidies to purchase private health insurance through the new state health exchanges, because you only qualify if you don’t have employer-sponsored health insurance.” The only other way people with employer-sponsored insurance will be able to participate in the health exchanges is if their premiums are more than 9.5 percent of their income. Even then, Sommers says, the health care law may not help this group. Families under 400 percent of the federal poverty level (FPL) will stay in a gray area — not quite qualified for subsidies in the health care exchanges and not quite qualified for the expanded Medicaid coverage for those below 138 percent of the FPL.

Older Americans who qualify for Medicare are also feeling the pinch. The study notes, “Compared with younger people, medical bill problems typically have been much lower among people aged 65 and older, despite higher out-of-pocket spending because of elderly people’s greater health care needs. Marking a significant upward trend, the proportion of elderly people with medical bill problems rose from 6.9 percent in 2003 to 10.3 percent in 2010.”

This study is featured in our weekly Research Roundup along with other health care studies and reports.

This article was updated to correct the information on seniors and income.